The Single Strategy To Use For Eb5 Investment Immigration

The Single Strategy To Use For Eb5 Investment Immigration

Blog Article

The 15-Second Trick For Eb5 Investment Immigration

Table of ContentsAn Unbiased View of Eb5 Investment ImmigrationWhat Does Eb5 Investment Immigration Mean?The Best Strategy To Use For Eb5 Investment ImmigrationAbout Eb5 Investment ImmigrationGetting The Eb5 Investment Immigration To Work

While we strive to use accurate and up-to-date content, it needs to not be considered legal recommendations. Immigration legislations and laws go through change, and specific conditions can vary commonly. For personalized advice and lawful guidance concerning your details immigration circumstance, we highly suggest consulting with a qualified immigration attorney that can provide you with tailored support and ensure compliance with current regulations and regulations.

Citizenship, through financial investment. Currently, since March 15, 2022, the amount of financial investment is $800,000 (in Targeted Employment Locations and Rural Areas) and $1,050,000 elsewhere (non-TEA zones). Congress has actually accepted these amounts for the next 5 years beginning March 15, 2022.

To get approved for the EB-5 Visa, Investors must produce 10 permanent united state tasks within 2 years from the day of their complete financial investment. EB5 Investment Immigration. This EB-5 Visa Need ensures that investments contribute straight to the united state work market. This uses whether the tasks are created directly by the commercial business or indirectly under sponsorship of a marked EB-5 Regional Facility like EB5 United

The 8-Second Trick For Eb5 Investment Immigration

These tasks are figured out via versions that utilize inputs such as advancement prices (e.g., building and construction and devices costs) or yearly incomes produced by recurring operations. On the other hand, under the standalone, or direct, EB-5 Program, only straight, permanent W-2 staff member positions within the business may be counted. A key risk of relying only on direct employees is that personnel reductions because of market problems might result in inadequate full time placements, possibly bring about USCIS rejection of the capitalist's request if the work creation requirement is not met.

The financial design after that projects the variety of straight tasks the new business is likely to create based upon its awaited incomes. Indirect work determined through financial models describes employment created in markets that supply the products or solutions to business straight associated with the job. These jobs are created as a result of the increased demand for items, materials, or solutions that sustain business's procedures.

Eb5 Investment Immigration - An Overview

An employment-based 5th choice group (EB-5) investment visa provides a method of ending up being a permanent U.S. resident for foreign nationals hoping to invest funding in the USA. In order to use for this copyright, an international financier must spend $1.8 million (or $900,000 in a Regional Facility within a "Targeted Work Area") and produce or protect at the very least 10 full time work for United States workers (excluding the capitalist and their immediate household).

This procedure has actually been a tremendous success. Today, 95% of all EB-5 capital is elevated and spent by Regional Centers. Considering that the 2008 monetary crisis, accessibility to funding has been tightened and metropolitan spending plans proceed to face considerable shortages. In numerous regions, EB-5 financial investments have actually loaded the funding space, offering a new, important source of capital for neighborhood financial growth jobs that rejuvenate neighborhoods, develop and support work, infrastructure, and solutions.

The Definitive Guide to Eb5 Investment Immigration

workers. In addition, the Congressional Spending Plan Office (CBO) racked up the program as earnings neutral, with management expenses spent for by candidate fees. Full Report EB5 Investment Immigration. Greater than 25 countries, including Australia and the United Kingdom, use similar programs to attract international investments. The American program is much more rigorous than numerous others, calling for considerable danger for financiers in regards to both their economic investment and immigration status.

Family members and people who seek to move to the United States on an irreversible basis can use for the EB-5 Immigrant Investor Program. The United States Citizenship and Migration Provider (U.S.C.I.S.) set out numerous requirements to acquire irreversible residency with the EB-5 visa program.: The initial step is to find a certifying investment opportunity.

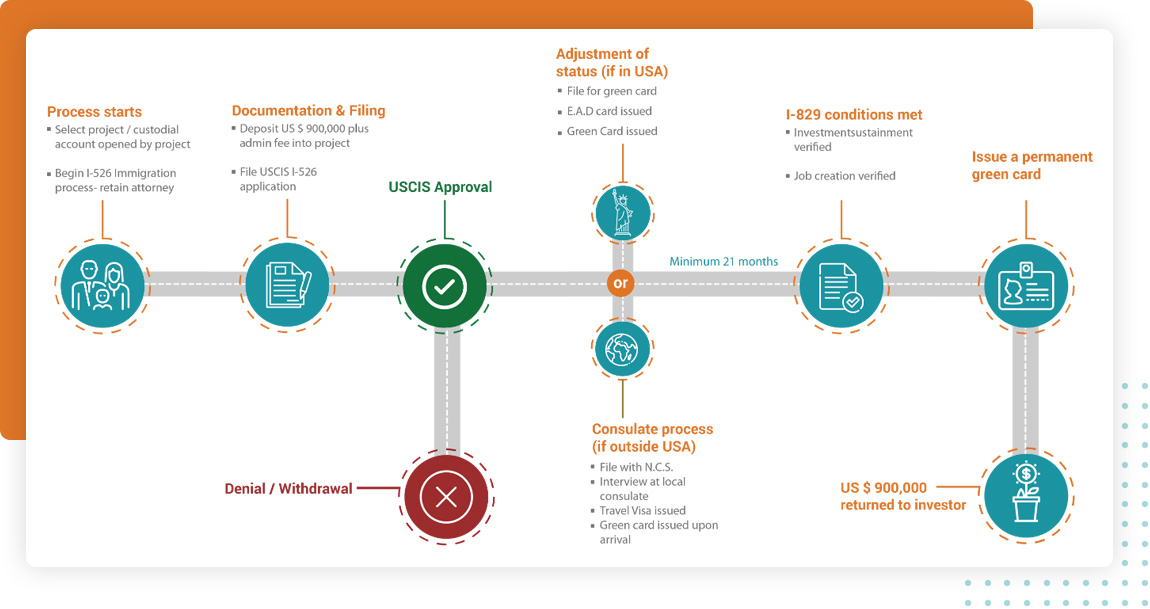

When the possibility has actually been determined, the investor has to make the financial investment and submit an I-526 request to the U.S. Citizenship and Immigration Provider (USCIS). This application needs to include proof of the investment, such as bank declarations, purchase arrangements, and service strategies. The USCIS will certainly evaluate the I-526 request and either accept it or see this website demand extra evidence.

6 Simple Techniques For Eb5 Investment Immigration

The capitalist needs to apply for conditional residency by submitting an I-485 petition. This petition should be submitted within 6 months of the I-526 approval and need to consist of evidence that the financial investment was made and that it has actually developed a minimum of 10 full time work for U.S. employees. The USCIS will certainly assess the I-485 petition and either approve it or request extra proof.

Report this page